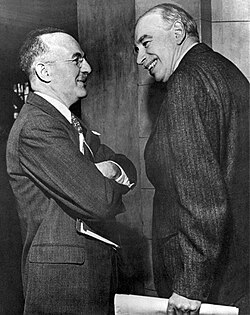

Although attended by 44 nations, discussions at the conference were dominated by two rival plans developed by the United States and Britain. As the chief international economist at the U.S. Treasury in 1942–44, Harry Dexter White drafted the U.S. blueprint for international access to liquidity, which competed with the plan drafted for the British Treasury by Keynes. Overall, White's scheme tended to favor incentives designed to create price stability within the world's economies, while Keynes' wanted a system that encouraged economic growth.

At the time, gaps between the White and Keynes plans seemed enormous. Outlining the difficulty of creating a system that every nation could accept in his speech at the closing plenary session of the Bretton Woods conference on July 22, 1944, Keynes stated:

We, the delegates of this Conference, Mr. President, have been trying to accomplish something very difficult to accomplish.[...] It has been our task to find a common measure, a common standard, a common rule acceptable to each and not irksome to any.

Keynes' proposals would have established a world reserve currency (which he thought might be called "bancor") administered by a central bank vested with the possibility of creating money and with the authority to take actions on a much larger scale (understandable considering deflationary problems in Britain at the time).

In case of balance of payments imbalances, Keynes recommended that both debtors and creditors should change their policies. As outlined by Keynes, countries with payment surpluses should increase their imports from the deficit countries and thereby create a foreign trade equilibrium. Thus, Keynes was sensitive to the problem that placing too much of the burden on the deficit country would be deflationary.

But the United States, as a likely creditor nation, and eager to take on the role of the world's economic powerhouse, balked at Keynes' plan and did not pay serious attention to it. The U.S. contingent was too concerned about inflationary pressures in the postwar economy, and White saw an imbalance as a problem only of the deficit country.

Although compromise was reached on some points, because of the overwhelming economic and military power of the United States, the participants at Bretton Woods largely agreed on White's plan.